Business opportunities are all around us. They are all asking us to invest our hard-earned money in them. However, to take that jump into being a business owner or investor is going to be a serious decision. You’ll need to be sure that your money is not going to waste. That is why being able to check on the value of a business is important.

For some businesses, it can be as simple as looking at the EIS/SEIS scheme assessment of the company. However, it can be more complicated for other businesses.

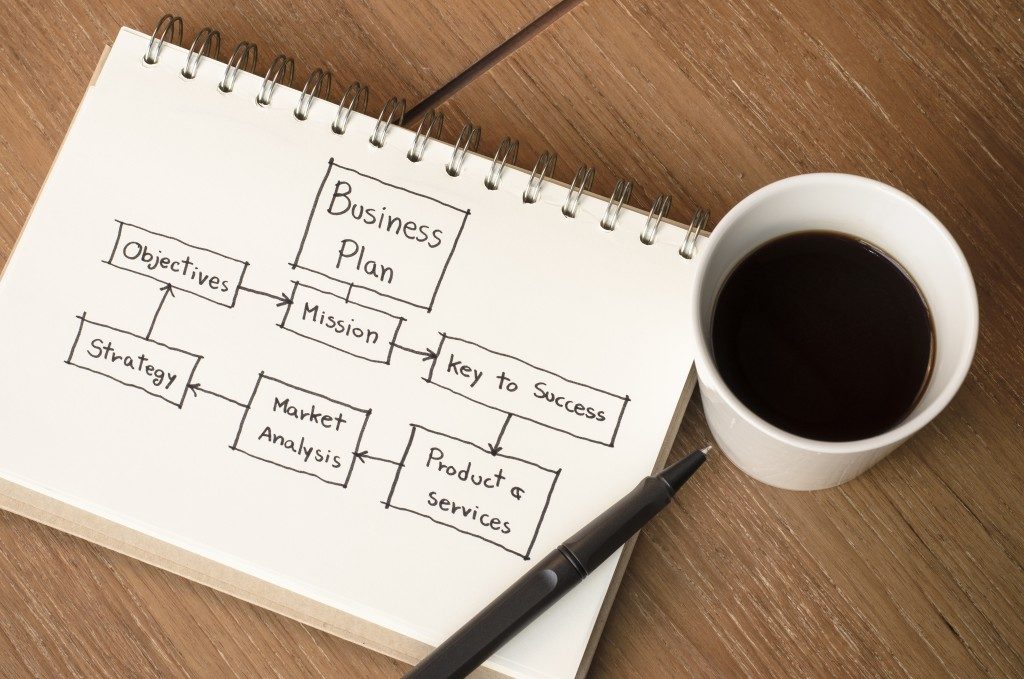

Here is a quick look at what you should do to evaluate whether a business opportunity is ready to blossom.

Know the Target Market

All businesses are targeting a certain demographic. Whether it is offering a product or service, it will have someone it’s intended for. You need to know whether the audience will be big and profitable enough.

The market analysis is the most important. This identifies how big the market is or how saturated it is. Determine whether there is room for your business in that market. This may actually have you stopping immediately and deciding that the business is not going to be profitable at all. If the results of the analysis are good, then you may proceed with the business idea.

Identify What Makes it Different

Now, it’s time to look closely at the business. You need to identify what makes your business different from the competition. Is your product better than the rest? Is it cheaper? Will this be enough to get the attention of the customers?

Every business has a unique selling point that is supposed to have people come to the business. If you check your unique selling point and it is not impressive enough, then the business might be in trouble. It will be up to you to decide whether to change the selling point or not.

Look at the Competition

The next step is to look at what the competition is doing. It’s not a simple comparison but scouting of what the market will become. For example, if a competitor is moving towards a particular service or feature, then you should determine whether it would overlap with your own services or products. Maybe they will be ahead of you when implementing what you think is a unique business approach. This could steal your thunder and potential profits.

Crunch the Numbers

How much money will you need to invest in this business opportunity? Financial feasibility looks at the necessary investment, the potential expenses, and the amount you will be hoping to earn from this opportunity. It will also point out how long you have to wait before the business can be profitable.

With the above evaluation done, it is up to you to decide if the business is worth buying or investing in. Use all the help you can get when making this important decision. If your judgment is sound, you might be able to get a big chunk of the potential market and earn a good profit.